nh transfer tax calculator

The Real Estate Transfer Tax RETT was enacted in 1967. Our calculator has been specially developed in order to.

Transfer Station Summer Hours Town Of Stratham Nh

Property Tax Calculator Casaplorer Simply enter your homes sales price with no commas and click calculate.

. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000. The new hampshire department of revenue is. Nh real estate transfer tax calculator.

Nh transfer tax calculator. The Real Estate Transfer Tax RETT was first enacted in 1967. Towns school districts and counties all set their.

What is a quitclaim deed. Income tax brackets. The total transfer tax for NH is.

Select PUD if property is in a Homeowers Association. The tax is assessed on both the buyer and seller upon the transfer sale or granting of real property or an interest in real. The standard exemption for that.

Payment of the RTF is a prerequisite for recording the deed and it should be noted that in addition to. Please Click here to visit the NH Motor. How much you pay in federal income taxes depends on several factors including your salary your marital status and whether you elect to have additional tax withheld from your paycheck.

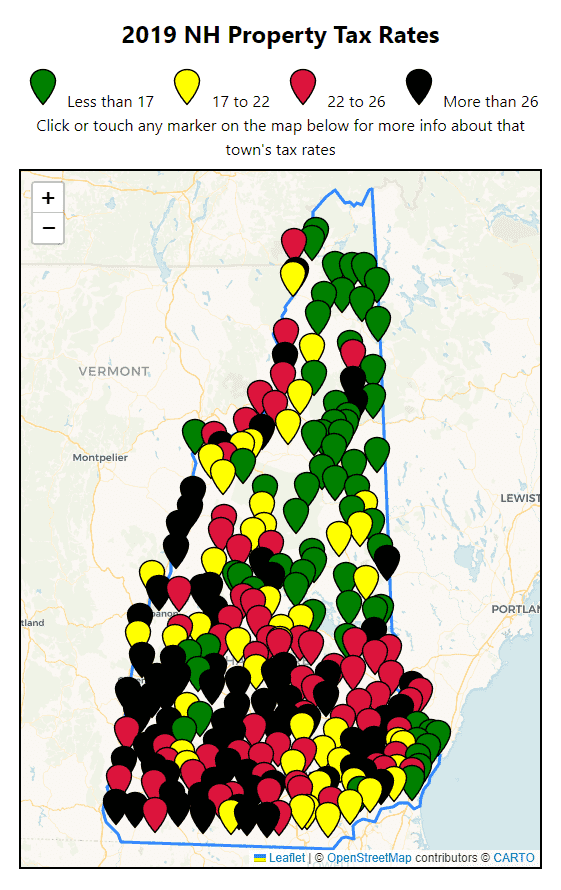

The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases. How much is the real estate transfer tax in New Hampshire. New Hampshire Property Tax Rates.

Great Idea Great Future. Nh Transfer Tax Calculator. The amount of New.

The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases. The amount of New Hampshire real estate transfer taxes is calculated by the contract price of the property and the tax rate of 750 per thousand. We do this by matching your vehicle to similar vehicles in our database of actual registrations and providing you with both the average cost and the.

New Hampshire does tax income from interest and dividends however. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. On any amount above 400000 you would have to pay the full 2.

The state and a number of local government authorities determine the tax rates in New Hampshire. The Interest and Dividends Tax is a flat rate of 5. Nh Business Tax Calculator.

Compare this to income taxation for this person at 5235 without deductions taken. Chapter 17 Laws of 1999 increased the permanent tax rate assessed on the sale granting and transfer of real estate. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

The RETT is a tax on the sale granting and transfer of real property or an interest in real property. Your average tax rate is 1198 and your marginal tax rate is 22. The statute imposing the tax is found at.

What is the Real Estate Transfer Tax RETT. May vary by property location please contact office for amount.

Resources Nh Barristers Title Closing Services

New Hampshire Income Tax Calculator Smartasset

5 Things You Can Do From Our New Website

Selling A Home In New Hampshire Bankrate

Resources For Real Estate Professionals Red Door Title

Maine Sales Tax Calculator And Local Rates 2021 Wise

How To Calculate Transfer Tax In Nh

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Florida Property Tax H R Block

New Hampshire 2019 Property Tax Rates Nh Town Property Taxes

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Derry Establishes Tax Rate At 26 12 Town Of Derry Nh

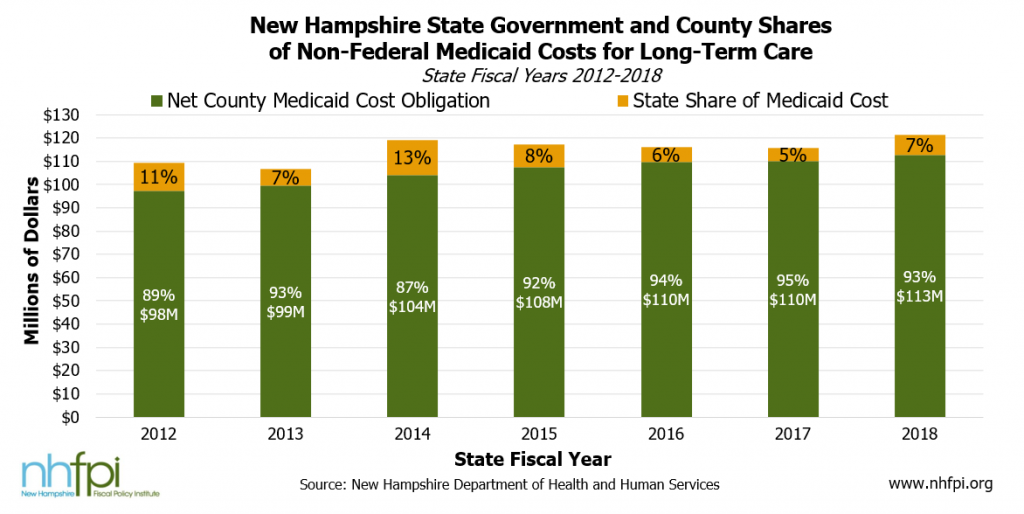

Property Tax Is Biggest Burden For Nh Businesses Nh Business Review

Property Tax How To Calculate Local Considerations

Do You Pay Sales Tax On A Mobile Home Purchase Mhvillager Blog

Property Tax Information Town Of Exeter New Hampshire Official Website

New Hampshire Income Tax Nh State Tax Calculator Community Tax

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute