washington state capital gains tax vote

State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. Earnings from retirement accounts and home sales.

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Washington enacted a 7 tax on the long-term capital gains of individuals in excess of 250000 resulting from the sale of certain capital assets.

. Washington State Representative Jim Walsh R-Aberdeen issued the following statement on the. Heading into session there were two proposals for a capital gains tax HB 1496 in the state House and another in the state Senate SB 5096 requested by the Office of Financial Management which. Washingtons advisory votes are.

The answer from voters by a wide margin was no with a vote of 63 to 37. Advisory Vote 37 is meant to gauge public opinion. While only three amendments passed none was more consequential than Sen.

The Washington Repeal Capital Gains Tax Measure is not on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. Majority Democrats in the Washington Senate passed a capital gains tax bill - something thats been talked about for a decade - over the weekend. During Saturdays vote in the Senate the capital gains tax legislation sponsored by Sen.

On Saturday the Senate narrowly passed legislation by a vote of 25-24 to establish a capital gains tax. After several hours of debate the House passed the Senates capital gains tax bill Wednesday in a 52-46 vote bringing Democrats one step closer to rebalancing Washingtons tax code. Other proponents have filed multiple versions of similar initiatives.

Under the unusual dynamics of the COVID-19. The video above aired May 4 2021 when Washingtons capital gains tax was signed into law. The Sunday vote on the capital gains bill mostly along party lines primarily targets stock and business ownership sales with a 7 tax for the first time in.

Of course all the states Office of Financial Management can do is assume that capital gains will increase every year whereas in practice capital gains are exceedingly volatile. The repeal side of an advisory vote on a capital gains tax approved by the state Legislature is out to an early lead following Tuesday nights. An advisory vote on Washington states new capital gains tax on high-profit assets was failing after an initial round of election results were released Nov.

The bill imposes a seven percent tax on capital gains in excess of 250000 realized from the. The sponsor filed multiple versions of the initiative and some. June Robinson D-Everett would establish a capital gains tax of 7 percent on capital gains that exceed 250000 in a given year.

An advisory vote on Washington states new capital gains tax on high-profit assets was failing after an initial round of election results were released Nov. Jun 13 2022. Thats because initiative supporters have dropped plans to proceed with the campaign opting instead to see how things play out regarding a lawsuit challenging.

DJ Wilson March 10 2021. Voters in Washington state will get their chance to weigh in Tuesday at least symbolically on the controversial new capital gains income. This initiative would repeal a 7 capital gains tax that was set to begin being collected in 2023.

The State has appealed the ruling to the Washington Supreme Court. Engrossed Substitute Senate Bill 5096 sponsored by Sen. Washington Advisory Vote 37 was a question to voters on whether to maintain the capital gains income tax increase passed by the Legislature during the 2021 session.

About 63 of voters say the measure should be repealed and. In March of 2022 the Douglas County Superior Court ruled in Quinn v. OLYMPIA Washington voters were rejecting a state advisory measure to adopt a new 7 tax on capital gains above 250000 in Tuesday nights election results.

The narrow 25-24 vote followed a nearly four-hour. The Washington Repeal Capital Gains Tax Initiative may appear on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. Voters in Washington state will get their chance to weigh in Tuesday at least symbolically on the controversial new capital gains income tax set to go into effect on Jan.

Advisory Vote 37. By contrast the capital gains tax proposed by Gov. The realization of capital gains slid 71 percent between 2007 and 2009 55 percent in 1987 and 46 percent in 2001.

June Robinson faced nineteen floor amendments. Jay Inslee in December is estimated to raise 875 million per year at a rate of 9. The Center Square Initiative 1929 which would repeal Washington states nascent capital gains tax wont be on the ballot this year.

SEATTLE - Voters will weigh in on Washington states new capital gains tax on high-profit. Steve Hobbss amendment 413 which removed the emergency clause from the underlying bill. The bill now heads back to the Senate for final concurrence.

This initiative would have repealed a 7 capital gains tax that was set to begin being collected in 2023.

![]()

Update Plans To Tax The Rich Advancing In Wa Legislature In 2021 Crosscut

Washington Enacts New Capital Gains Tax For 2022 And Beyond Insights Davis Wright Tremaine

Tax Insights Timely Industry News Thought Leadership

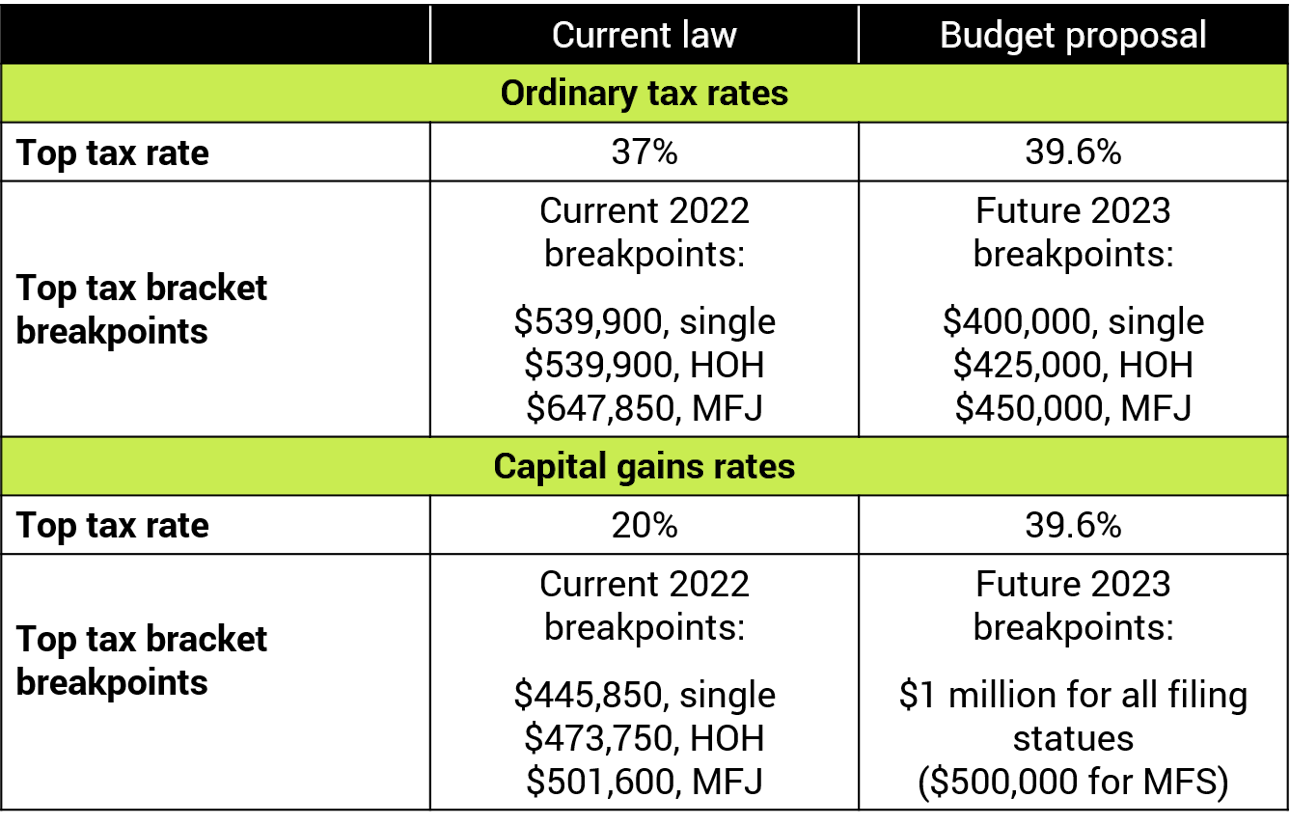

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Today Marks The Last Day For Filing Annual Income Tax Returns Fbr Income Tax Tax Return Income Tax Return

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Navigating Washington State S New Capital Gains Tax Coldstream Wealth Management

New Taxes Will Hit America S Rich Old Loopholes Will Protect Them The Economist

House Democrats Propose Hiking Capital Gains Tax To 28 8

Biden Tax Plan Corporate Capital Gains And Income Hike Uncertain

A2z Valuers Offers Valuation Services In Field Of Capital Gain Valuation Every Body Can Get His Profit With That Https Goo Gl Vqt Bell The Cat Job Creation

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Geekwire

Initiative To Repeal Capital Gains Tax Stalls In Washington State Axios Seattle

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Geekwire

2022 And 2021 Capital Gains Tax Rates Smartasset

Are You Person Black S Law Dictionary Definition Of A Person Law Books Law Dictionary

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Geekwire